As leader during a merger or acquisition, your focus is creating value from the transaction.

Unfortunately, despite the complexity of both completing the deal and navigating a post-merger integration (PMI)—and the real-world danger of not getting it right—research indicates that simply finalizing a merger does not automatically generate shareholder value, operational efficiencies or cost reductions.

Why not?

PMI is fraught with the grinding gears of clashing cultures, misunderstood strategies, misaligned priorities, and miscommunicated initiatives. Although the PMI process typically includes strategic direction, the needed operational plans required to support a smooth team (and individual contributor) transition are usually non-existent.

As a result, the PMI timeframe and impact slips further and further beyond your grasp, leading to growing frustration for everyone.

There is a better way: The PMI equivalent of Tesla’s insane mode – zero to 60 in 3.2 seconds!

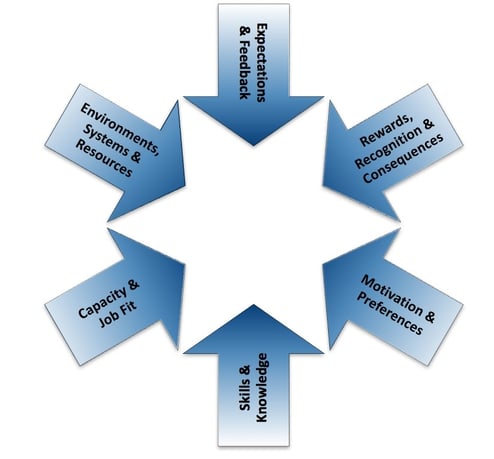

Our approach is built on a model for high performance entitled the Exemplary Performance System (EPS) (Fig. 1), based on years of research and then refined through decades of application. The EPS accelerates a post-merger integration so that combined organizations operate as a seamless, integrated unit with a high-performance culture.

Post-merger Integration that Leads to a High-Performance Culture

In typical PMI efforts, focus is placed on only two of the six key influences:

- Rewards, Recognition & Consequences, and

- Environments, Systems &

Since these are areas where financial gains are quickly discernible, they tend to capture the bulk of the attention of leadership.

However, these two are simply the beginning. Detailed execution of all six influences is necessary to optimize the results of any merger or acquisition. All six are needed to blend people and work systems together to create a highly engaged post-merger team. When the PMI process is based on the EPS, each team and individual knows the rationale for the merger and, more importantly, how their position and team fits into the new strategy.

In turn, this allows your organization to:

- Provide clear expectations so that everyone in your organization knows exactly what is expected of them in the new, post-merger world; there will be no conflicting goals and feedback will be timely and

- Create a work environment and culture that is conducive to outstanding performance on a day-in and day-out

- Ensure that everyone in the company, from top to bottom, feel as if they were integral members of a successful

- Assign all the employees to jobs that enables them to perform at the top of their game with the right skills and tools for meeting and exceeding their goals and

Accelerating Change

Another advantage of the EPS approach is that it overcomes the natural internal resistance to a merger that inevitably happens when workers feel like pawns in someone else’s game. In a typical PMI process, instead of being asked to contribute, people are simply required to respond to new dictates from on high. In other words, the acquired company and its employees are usually left anxiously waiting for the next shoe to drop.

In contrast, a key component of EPS is to capture best practices from both organizations.

We help leaders to identify exceptional high performers in the most critical roles, who consistently produce exceptional results. These individuals—and the teams they are part of—are easy to spot because they tackle each day with energy and engagement. For example, it is common for performers in the top 10% of a sales organization to generate 30% to 50% percent or more of the revenue. In software engineering, top programmers write ten times (yes, 10X) the amount of bug-free code than their average counterparts.

Would it be nice to harness that kind of mastery from individuals in both organizations?

This approach to integration isn’t crafted in the boardroom and then pushed out to operations, but rather ‘captured’ from star performers—currently spread throughout the newly combined enterprise—and then transfused back into the bloodstream of the entire team.

In turn, when employees recognize these ‘homegrown’ approaches and practices are based on the performance of their highly regarded peers, this creates an environment that encourages emulation among the solid performers. One global high-tech firm (with whom we’ve worked for over a decade) refers to the results of our work as ‘from the field, for the field.’

For more information on how your organization can leverage the EPS system to help you maximize the value of your merger or acquisition, please visit: www.shiftthework.com/consulting

Quick reference guide for the 6 arrows reflected in the EPS:

Expectations and Feedback

Providing clear expectations and feedback is not just a good idea, it is essential for performers, teams and departments, especially during times of extreme change. To optimize this influence, you need to clearly define the accomplishments required by each key role/team, the key actions required to produce those accomplishments, and the corresponding KPIs.

Rewards, Recognition and Consequences

You don’t want to provide rewards and incentives in an arbitrary manner or in a way that rewards effort alone, but rather in a way that is aligned with the goals of the merger. Before rewarding effort, you must ensure that effort is aligned in the proper direction.

Motivation and Preferences

Understanding the motivation and preferences of key performers facilitates the optimal assignments in the new organization and the alignment of meaningful recognition and rewards.

Skills and Knowledge

People in key roles will need additional training to support the changes occurring due to the merger. Training should be designed based on the accomplishments needed for the merger to succeed.

Capacity and Job Fit

An understanding of the outputs produced by the people in key roles allows you to clarify job descriptions and make staff assignments based on detailed job expectations. This clarity enables you to identify ideal candidates from both organizations based on whether a person has successfully produced analogous outputs required for the new role.

Environments, Systems and Resources

You need to discern what resources, systems and tools are required so that people in each critical role can operate at an optimal level.

Paul H. Elliott is a Consultant at SHIFT, and the President of Exemplary Performance, LLC